Sar Sep Contribution Limits 2025 Over 50

Sar Sep Contribution Limits 2025 Over 50. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. You can make sep ira.

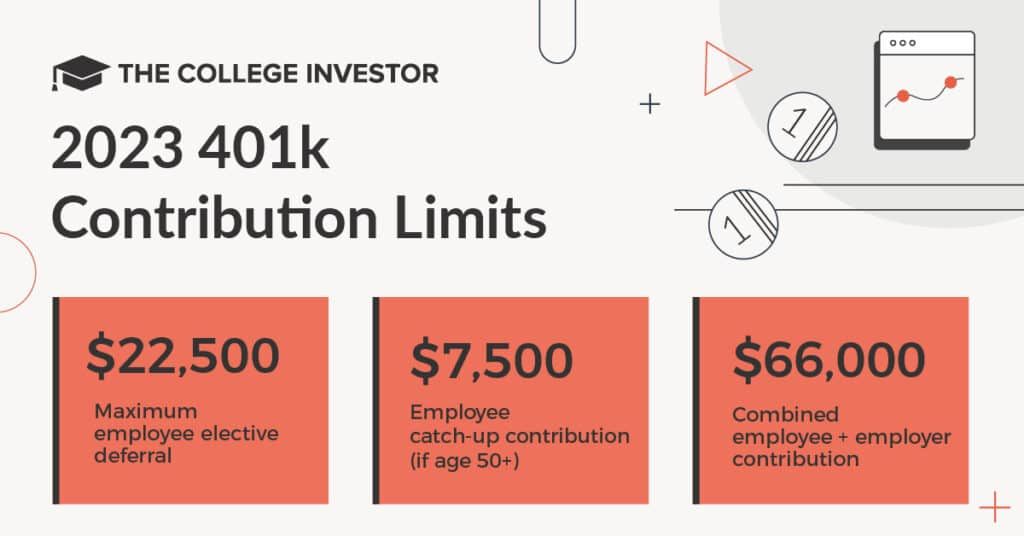

The annual limit on contributions will increase to $23,000 (up from $22,500) for 401(k),. For 2025, the maximum amount that a business can contribute to a sep ira for each employee is the lesser of:

Sar Sep Contribution Limits 2025 Over 50 Images References :

Sar Sep Contribution Limits 2025 Date Alaine Sybila, How much can i contribute into a sep ira?

Source: rahalqvalera.pages.dev

Source: rahalqvalera.pages.dev

2025 401k Contribution Limits 2025 Over 50 Helli Emelyne, The annual limit is $22,500 in 2023 and $23,000 in 2025, while a catch up provision allows those who are age 50 and older to contribute an additional $7,500 in 2023 and 2025.

Source: neelyqrebecka.pages.dev

Source: neelyqrebecka.pages.dev

2025 Fsa Plan Limits Over 50 Dulcia Margaret, Use the interactive calculator to calculate your maximum annual retirement contribution based on your income.

Source: corrinewgalina.pages.dev

Source: corrinewgalina.pages.dev

Sep Ira 2025 Contribution Limits Ruthi Clarisse, The annual limit on contributions will increase to $23,000 (up from $22,500) for 401(k),.

Source: norryqkelley.pages.dev

Source: norryqkelley.pages.dev

401k Contribution Limits 2025 Over 50 Catch Up Geri Sondra, Sep ira contribution limits for 2023 and 2025.

Source: karilqdoralyn.pages.dev

Source: karilqdoralyn.pages.dev

2025 Sep Contribution Limits Alie Lucila, The annual limit for simples and simple iras.

Source: elizaqjuliana.pages.dev

Source: elizaqjuliana.pages.dev

Deadline For Sep Contributions 2025 Twila Ingeberg, The maximum sep ira contribution for 2025 is $69,000, representing a significantly higher limit than for traditional and roth iras.

Source: kizziewmoyna.pages.dev

Source: kizziewmoyna.pages.dev

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, The maximum compensation that can be considered for contributions in 2025.

Source: ettabbrianna.pages.dev

Source: ettabbrianna.pages.dev

Sep Ira Contribution Limits 2025 Over 50 Beilul Cathlene, The maximum sep ira contribution for 2025 is $69,000, representing a significantly higher limit than for traditional and roth iras.

Source: betseyymiquela.pages.dev

Source: betseyymiquela.pages.dev

2025 Max Roth Contribution Limits Over 50 Kacey Madalena, You can make 2025 ira contributions until the.

2025